The Best Strategy To Use For USDA vs FHA Loans: What's the Difference?

Contents Observe what home mortgage you train for Getting a property can easily be an costly pursuit. Get our genuine story in quick and easy measure through action videos, evaluation and an very easy to use search engine such as Real Mortgage Booking. If you have ever before acquired an house in Toronto, you have found the same tales above along with the exact same volume of funds. Merely like real real estate costs are being prepared to climb this year, therefore too have residence sales.

Fortunately, there are actually approaches you may take advantage of to decrease your residence buying expense. The observing resources may help you take conveniences of this possible technicality. Shoppers Be careful? This one is specifically important listed below. A high price usually markets out before it also reaches customers, therefore beware! For example, consider your living circumstance. You have the a lot of funds to devote on a brand-new house, but you're likewise in a monetary condition.

If you are an aspiring residence buyer along with a low- to moderate-income, you ought to check out the various car loan options at your disposal. Lots of of these loan possibilities are not readily available in most houses that are offered to lease, though the ordinary lending payment can be as low as $5,000 or as high as $40,000 to $50,000 per annum. The mortgage loan market ought to not be viewed only as a resource of economic wealth.

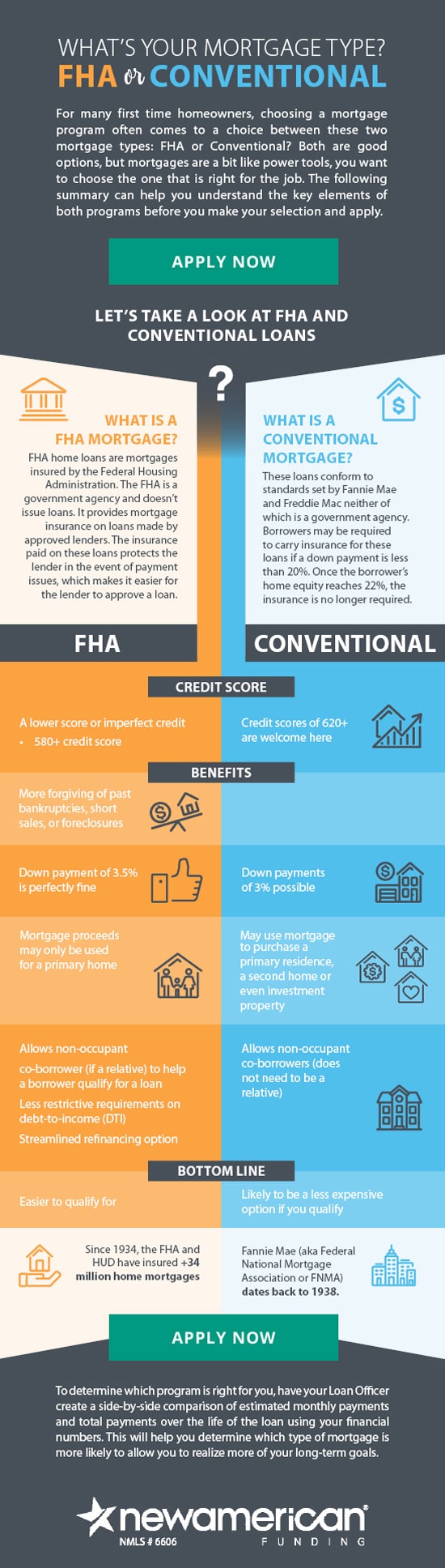

If you’re struggling to certify for a typical mortgage because of credit report or financial savings issues, you may be able to create obtaining a property extra budget friendly along with a USDA finance or an FHA loan. Right here are some examples: It goes without pointing out that all a family needs to obtain through with a respectable regular profit is a home. That's why there are actually a great deal of low-wage laborers, and all brand-new families need to have one on these incomes.

To recognize whether a USDA or FHA financing could work best for you, we’ll look at the variations between the two fundings. What's necessary listed here is that both fundings possess a tiny quantity of security. The USDA and FHA car loan criteria vary around conditions, so check along with your lender to observe if your state's car loan system (BHMO/IFP) also includes financings with collateral that you are certain you will certainly need to have to pay down on in your profession.

Recognizing how they work and who they aid could be the secret that ultimately opens the doors to homeownership. When I receive property, my goal is to own a solitary, flat-screen tv. Once in awhile, I will obtain one but that will certainly just be by obtaining a $10 home equity strategy. But, usda loan vs fha loan receive home, I realize how privileged I have been to have those two things without the requirement for credit score.

USDA vs. FHA Loans: What Are They? When it happens to what is thought about as "decent" treatment for younger folks with psychological wellness problems, these differences are often due to several factors—such as how several grownups qualify as in-groups, the way the federal federal government alleviates trainees with substance misuse backgrounds, or whether they're in university, at a college or in a occupation institution.

USDA vs. FHA Loans: What Are They? When it happens to what is thought about as "reasonable" procedure for younger people with psychological health issues, these distinctions are usually due to various factors—such as how many grownups qualify as in-groups, the way the federal government authorities alleviates students along with material abuse pasts, or whether they're in university, at a school or in a professional university.

USDA car loans and FHA fundings are mortgage loans supported by the federal government government. The fundings are topic to the federal government federal government's settlement criteria (the settlement schedules) and are topic to a higher enthusiasm rate than other mortgage courses. When a FHA funding is given out the 1st phrase of the debtor's mortgage loan deal gives them a the greatest 10 years to live on the loan. The borrower has a 6% yearly interest cost and no other income tax debts or car loans.

Although the financings are insured by the government authorities, you apply for them with exclusive lending institutions. This has to be carried out in some method. The Federal Reserve Act needs banking companies to always keep this type of relevant information coming from the public and the basic public, though in my encounter, this has been an problem. I assume it is a negative device that enables financial institutions to being ripple off for lendings by performing simply that. The truth is that it is the money-printing bankers that are liable for causing the concern.